Just when we thought tariff talk had gone quiet, it’s back on center stage. With the reciprocal tariff deadline landing this Wednesday, President Trump has mailed out notices that new duties will kick in on August 1. Countries such as Japan, South Korea, Malaysia, and Kazakhstan face a 25% levy, while a few others may see steeper rates.

Wall Street didn’t take the news well. On Monday, the S&P 500 ($SPX) closed lower by 0.79%.

Before the July 4 long weekend, the S&P 500 and Nasdaq Composite ($COMPQ) notched fresh record highs, buoyed by solid jobs data. But like migratory birds, tariffs circled back on Monday and pushed stocks lower almost across the board.

Monday’s performance can be encapsulated by the StockCharts MarketCarpets screenshot below. It was pretty much red except for a few lonely green squares.

FIGURE 1. STOCK MARKET’S PERFORMANCE ON MONDAY, JULY 7. Besides a few lonely green squares, the screen lit up red. Image source: StockCharts.com. For educational purposes.

Why Pullbacks Can Be Your Friend

Stock market pullbacks aren’t all bad. They give investors and traders a chance to go bargain hunting. A handy tool is the Market Movers panel in your StockCharts Dashboard. Check the “S&P 500 % Down” category to spot the 10 stocks in the index that had the largest % loss for the trading day. Then view the charts and see if any deserve a place in your ChartLists.

Two names that caught my eye:

- Tesla, Inc. (TSLA)

- ON Semiconductor Corp. (ON)

FIGURE 2. MARKET MOVERS PANEL FROM MONDAY, JULY 7. From this list, two stocks worth considering as “buy the dip” opportunities are TSLA and ON. Image source: StockCharts.com. For educational purposes.

Tesla, Inc. (TSLA): Sitting on the Fence

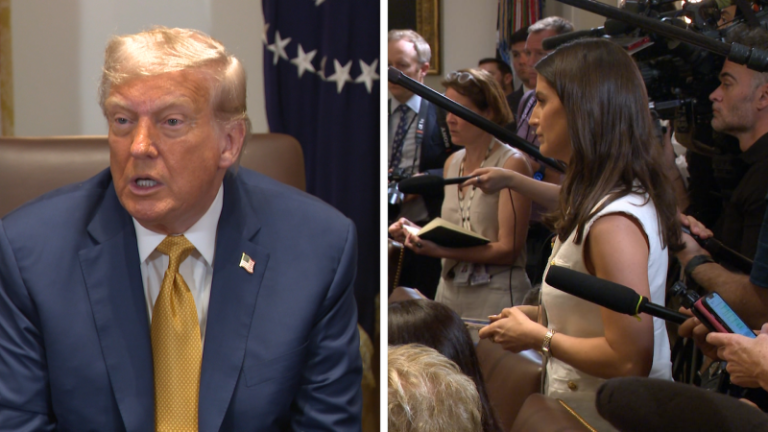

While it’s clear that politics helped knock TSLA down, the chart tells a fuller story.

From the daily chart of TSLA below, it’s clear that the stock has seen some erratic movement recently.

FIGURE 3. DAILY CHART OF TSLA’S STOCK PRICE. TSLA’s stock price has danced above and below its 200-day simple moving average, and momentum is relatively weak. Chart source: StockCharts.com. For educational purposes.

Since April, TSLA’s stock price looked like it was recovering after it broke out above its 200-day simple moving average (SMA). However, in early June it dipped below it and then went above it, and is now back below it. The June 23 high was below the end of May high. The relative strength index (RSI) and percentage price oscillator (PPO) indicate weakening momentum. The big question is where is TSLA going to find support?

Watch three support levels on your chart. TSLA’s stock price has moved above the first support level. Look for momentum to pick up to confirm the upside move. If TSLA’s stock price doesn’t hold at this level and falls further towards the $270 or $220 levels, similar conditions would apply. However, a significant fall in price would weaken momentum significantly and would need stronger evidence to consider going long.

ON Semiconductor (ON): Stalling at Resistance

ON has lagged its chip-making peers. Over the past year, ON Semiconductor has underperformed the VanEck Semiconductor ETF (SMH). ON supplies chips to automakers and manufacturers, so its fortunes rise and fall with car demand.

The daily chart of ON below shows that since early April the stock price has recovered with a series of higher highs and higher lows. It is now facing resistance of its 200-day SMA, a resistance area that coincides with the February high and the early January gap down. Momentum looks like it’s rising as indicated by the slight rise in RSI and a potential bullish crossover in the PPO.

FIGURE 4. DAILY CHART OF ON SEMICONDUCTOR. Since early April, ON has printed higher highs and higher lows. The stock price is now hovering around its 200-day SMA, and momentum seems to be gaining a little strength. Chart source: StockCharts.com. For educational purposes.

I would look for ON to clear $58 on strong volume and improving momentum before opening a long position.

Closing Position

- Add price alerts in StockCharts at each support level (for TSLA) or resistance level (for ON).

- When an alert triggers, re-evaluate the chart to confirm if momentum is strong enough for a price reversal and upside follow-through.

A short-term investment could be a better choice for TSLA since its price performance is correlated to Elon Musk’s involvement with the company.

ON could be a steadier, longer-term investment if the stock price breaks above resistance.

No matter what, decide in advance where you’ll place your stops. Then stick to your plan because discipline always wins.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.