Despite being dead for more than 300 years, this Indian ruler is still making waves in the nation’s politics.

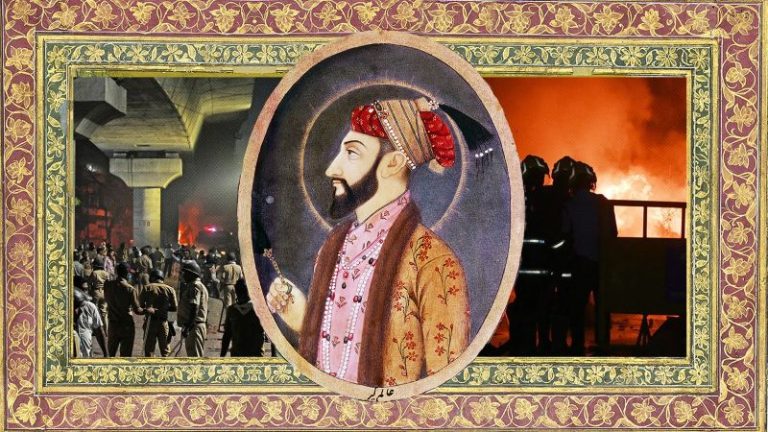

Aurangzeb Alamgir has become so central to India’s fraught political moment, his memory is leading to sectarian violence across the country.

The sixth emperor of the famed Mughal dynasty, he is considered by many detractors to be a tyrant who brutalized women, razed Hindu temples, forced religious conversions and waged wars against Hindu and Sikh rulers.

And in a nation now almost entirely under the grip of Hindu nationalists, Aurangzeb’s “crimes” have been seized upon by right-wing politicians, turning him into the ultimate Muslim villain whose memory needs to be erased.

Sectarian clashes erupted in the western city of Nagpur last month, with hardline Hindu nationalists calling for the demolition of his tomb, which is about 400 kilometers away.

Seemingly spurred on by a recent Bollywood movie’s portrayal of Aurangzeb’s violent conquests against a revered Hindu king, the violence led to dozens of injuries and arrests, prompting Nagpur authorities to impose a curfew.

As tensions between the two communities continue to mount, many right-wing Hindus are using Aurangzeb’s name to highlight historical injustices against the country’s majority faith.

And they are causing fears among India’s 200 million Muslims.

‘Admiration and aversion’

The Mughals ruled during an era that saw conquest, domination and violent power struggles but also an explosion of art and culture as well as periods of deep religious syncretism – at least until Aurangzeb.

Founded by Babur in 1526, the empire at its height covered an area that stretched from modern-day Afghanistan in central Asia to Bangladesh in the east, coming to an end in 1857 when the British overthrew the final emperor, Bahadur Shah II.

Its most well-known leaders – Humayun, Akbar, Jahangir and Shah Jahan – famously promoted religious harmony and heavily influenced much of Indian culture, building iconic sites such as the Taj Mahal and Delhi’s Red Fort.

But among this more tolerant company, Aurangzeb is considered something of a dark horse – a religious zealot and complex character.

Aurangzeb “evoked a mixture of admiration and aversion right from the moment of his succession to the Mughal throne,” said Abhishek Kaicker, a historian of Persianate South Asia at UC Berkeley.

“He attracted a degree of revulsion because of the way in which he came to the throne by imprisoning his father and killing his brothers… At the same time, he drew admiration and loyalty for his personal unostentatiousness and piety, his unrivaled military power that led to the expansion of the Mughal realm, his political acumen, administrative efficiency, and reputation for justice and impartiality.”

Born in 1618 to Shah Jahan (of Taj Mahal fame) and his wife Mumtaz Mahal (for whom it was built), historians describe the young prince as a devout, solemn figure, who showed early signs of leadership.

He held several appointments from the age of 18, in all of which he established himself as a capable commander. The glory of the Mughal empire reached its zenith under his father, and Aurangzeb’s scrambled for control of what was then the richest throne in the world

So when Shah Jahan fell ill in 1657, the stage was set for a bitter war of succession between Aurangzeb and his three siblings in which he would eventually come face-to-face with his eldest brother, Dara Shikoh, a champion of a syncretic Hindu-Muslim culture.

Aurangzeb imprisoned his ailing father in 1658 and defeated his brother the year after, before forcibly parading him in chains on a filthy elephant on the streets of Delhi.

“The favorite and pampered son of the most magnificent of the Great Mughals was now clad in a travel-tainted dress of the coarsest cloth,” wrote Jadunath Sarkar in “A Short History of Aurangzib.”

“With a dark dingy-colored turban, such as only the poorest wear, on his head. No necklace or jewel adorning his person.”

Dara Shikoh was later murdered.

By now, Aurangzeb’s authority had reached extraordinary heights, and under his leadership the Mughal empire reached its greatest geographical extent.

He commanded a degree of respect and for the first half of his reign, ruled with an iron fist, albeit with relative tolerance for the majority Hindu faith.

Until about 1679, there were no reports of temples being broken, nor any imposition of “jizya” or tax on non-Muslim subjects, according to Nadeem Rezavi, a professor of History at India’s Aligarh University. Aurangzeb behaved, “just like his forefathers,” Rezavi said, explaining how some Hindus even held high rank within his government.

In 1680 however, that all changed, as he embraced a form of religious intolerance that reverberates to this day.

The zealot ruler demoted his Hindu statesmen, turning friends into foes and launching a long and unpopular war in the Deccan, which included the violent suppression of the Marathas, a Hindu kingdom revered to this day by India’s right-wing politicians – including Prime Minister Narendra Modi.

Members of Modi’s Bharatiya Janata Party (BJP) have been quick to point out the cruelties inflicted on Hindus by Aurangzeb – forcing conversions, reinstating the jizya, and murdering non-Muslims.

He also waged war on the Sikhs, executing the religion’s ninth Guru Tegh Bahadur, an act makes Aurangzeb a figure of loathing among many Sikhs to this day.

This brutality was on display in the recently released film “Chhaava,” which depicts Aurangzeb as a barbaric Islamist who killed Sambhaji, the son of the most famous Maratha king, Chhatrapati Shivaji.

“Chhaava has ignited people’s anger against Aurangzeb,” said Devendra Fadnavis, the chief minister of Maharashtra, where Nagpur is located.

Muslims alleged members of the right-wing Vishwa Hindu Parishad (VHP) burned a sheet bearing verses from their holy Quran.

Yajendra Thakur, a member of the VHP group, denied the allegations but restated his desire to have Aurangzeb’s tomb removed.

Modi’s invocation of the man who led India before him is no surprise.

The prime minister, who wears his religion on his sleeve, has been a long-time member of the Rashtriya Swayamsevak Sangh, a right-wing paramilitary organization that advocates the establishment of Hindu hegemony within India. It argues the country’s Hindus have been historically oppressed – first by the Mughals, then by the British colonizers who followed.

And many of them want every trace of this history gone.

The Maharashtra district where he is buried, once known as Aurangabad, was renamed after Shivaji’s son in 2023. The triumphs of his forefathers, the great king Akbar and Shah Jahan, have been written out of history textbooks, Rezavi said, or not taught in schools.

“They are trying to revert history and replace it with myth, something of their own imagination,” Rezavi said. “Aurangzeb is being used to demonize a community.”

Modi’s BJP denies using the Mughal emperor’s name to defame India’s Muslims. But his invocation of India’s former rulers is causing fear and anxiety among the religious minority today.

While historians agree that he was a dark, complex figure, and don’t contest his atrocities, Rezavi said it is necessary to recognize that he existed at a time when “India as a concept” didn’t exist.

“We are talking about a time when there was no constitution, there was no parliament, there was no democracy,” Rezavi said.

Kaicker seemingly agrees. Such historical figures “deserve neither praise nor blame,” he said.

“They have to be understood in the context of their own time, which is quite distant from our own.”

Back in Nagpur, demands for the tomb’s removal have gone unanswered, with some members of the Hindu far right even dismissing the calls for demolition.

Local Muslim resident Asif Qureshi said his hometown has never seen violence like that which unfolded last month, condemning the clashes that convulsed the historically peaceful city.

“This is a stain on our city’s history,” he said.

This post appeared first on cnn.com