This week brought a fresh set of challenges to the tech sector, beginning with an announcement from the US Bureau of Industry and Security on Tuesday (March 25) of new export restrictions targeting 80 companies across Asia and the Middle East, impacting some of Big Tech’s key customers.

Consumer confidence weakened, further dampening market sentiment.

This was evidenced by the release of the Conference Board’s Consumer Confidence Index report on Tuesday, and the University of Michigan’s consumer sentiment survey, released on Friday (March 28).

Also on Friday, the latest US personal consumption expenditures price index data showed underlying inflation rising by 0.4 percent, renewing concerns over stagflation.

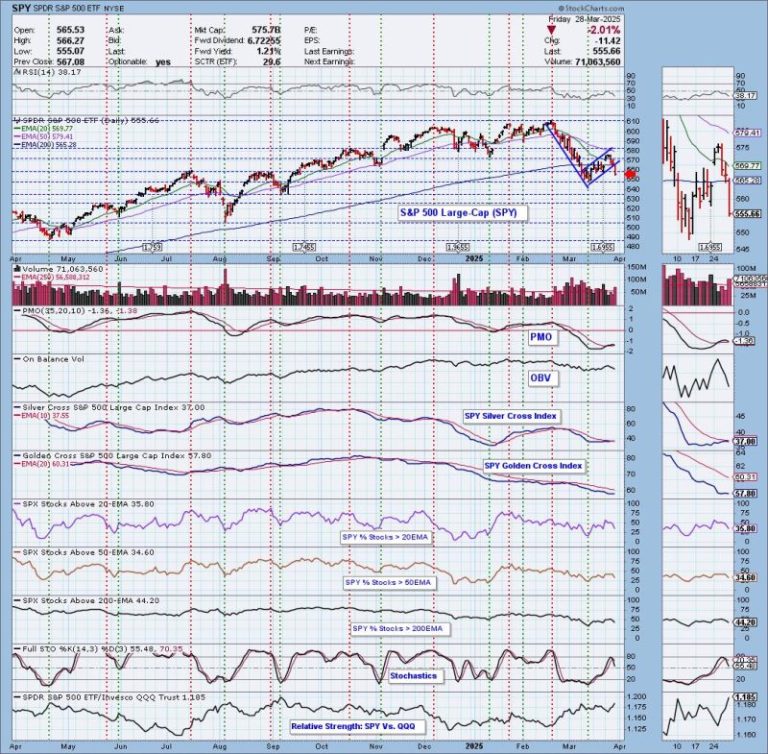

Combined, the latest data weighed on equities, and tech stocks led a broad market selloff on March 28 (Friday).

NVIDIA (NASDAQ:NVDA) ended the week 8.52 percent lower from its opening price on Monday (March 24), Meta Platforms (NASDAQ:META) logged losses of 6.22 percent and Microsoft (NASDAQ:MSFT) declined by 4.2 percent.

Meanwhile, Apple’s (NASDAQ:AAPL) share price pulled back by a modest 1.41 percent for the week.

Tesla (NASDAQ:TSLA) saw its price stage a bit of a recovery, ending the week 2.12 percent above Monday’s opening price, while other automotive companies like Ford Motor (NYSE:F) and General Motors (NYSE:GM) nursed losses following US President Donald Trump’s implementation of a 25 percent tariff on all auto imports.

Here’s a look at other key events that made tech headlines this week.

1. BYD shares Q4 results, Tesla sentiment improves

BYD (OTC Pink:BYDDF,SZSE:002594), China’s top car brand, reported its fourth quarter results on Monday, with net profits totaling 15 billion yuan (US$2.1 billion), a 73.1 percent increase compared to the previous year, and revenue growth of 52.7 percent to 274.85 billion yuan (US$37.89 billion) for the same period.

Looking ahead, BYD expects to ship up to 5.5 million vehicles in 2025.

The company also said this week that 500 of the approximately 4,000 super-fast charging stations needed to support its electric vehicle (EV) infrastructure in China will be ready by April.

These projections from BYD come as rival EV maker Tesla staged a partial comeback this week after suffering a roughly 25 percent decline in its share price earlier this month.

Investor sentiment may have been lifted by analysis from CFRA Research analyst Garrett Nelson, who said Tesla is the “least exposed” to Trump’s sweeping 25 percent automobile tariffs, announced on Wednesday (March 26).

According to Nelson, Tesla, which builds its cars in the US, stands to benefit from a projected reduction in consumer choices coupled with an increase in the prices of foreign-made vehicles.

“There are very few winners,” Sam Fiorani, vice president of global vehicle forecasting for AutoForecast Solutions, said in an interview with Bloomberg. “Consumers will be losers because they will have reduced choice and higher prices.”

Analysts are projecting that Trump’s auto tariffs could severely impact the economy.

“I think yesterday’s [tariff announcement on automobiles] is a bigger deal than the market is making it out to be,’ Ajay Rajadhyaksha, global chairman of research at Barclays, told CNBC on Thursday (March 27). ‘I think it reduces the risk that April 2 is something that markets can dismiss,’ he added. ‘I think we will be negatively surprised.’

2. Big Tech companies make AI advances

This week also saw significant advancements in artificial intelligence (AI) image generation and reasoning with the introduction of enhanced product offerings from some of Big Tech’s most prominent players.

OpenAI released 4o Image Generation to replace DALL-E 3 as the default image generation model for ChatGPT.

According to the company, the model can generate more realistic images than older image-generating models, as well as create lengthy, detailed, and precise text strings within images.

Meanwhile, Microsoft unveiled ‘deep reasoning agents’ for 365 Copilot, powered by OpenAI’s o1 and o3-mini models, featuring ‘agent flow’ for enhanced reliability. Elsewhere, Google’s (NASDAQ:GOOGL) DeepMind introduced Gemini 2.5 Pro, which it claims has superior reasoning capabilities over older iterations and competing models

3. CoreWeave downsizes IPO

CoreWeave’s initial public offering (IPO) journey concluded on Friday, following significant market scrutiny.

The company initially filed for a New York IPO on March 3, targeting a US$4 billion raise and a valuation exceeding US$35 billion. Its filings revealed US$1.9 billion in 2024 revenue but also substantial debt and escalating net losses, reaching US$863 million. This expansion was fueled by US$14.5 billion in debt and equity financing.

On March 20, CoreWeave announced the launch of its IPO, registering 49 million Class A shares with a projected price range of US$47 to US$55. The company was aiming to raise up to US$2.7 billion in an offering led by Morgan Stanley (NYSE:MS), JPMorgan (NYSE:JPM) and Goldman Sachs (NYSE:GS), with 11 other advisers participating. Analysts at CNBC projected the deal would value CoreWeave at US$26.5 billion, although that figure could go as high as US$32 billion.

However, the company opted to decrease the size and price of its IPO, setting levels at US$40 per share for 37,500,000 shares, resulting in a valuation of approximately US$23 billion.

CoreWeave’s lower IPO was due to a confluence of factors that dampened investor enthusiasm, including market conditions and financial concerns. A confidential investor survey reported by the Information found that 90 percent of respondents do not consider CoreWeave a favorable long-term investment.

“One respondent summed up a broader perception about CoreWeave: ‘It’s radioactive, and I think every investor knows that,’” market analyst Cory Weinberg wrote.

4. OpenAI revenue and funding rumors circulate

It was a big week for OpenAI, marked by reports on its expansion and projected financial growth.

According to a Wednesday report from the Information, OpenAI is exploring the construction of its first data center, which would be located in Texas near the Stargate data center site.

Concurrently, Bloomberg cited an anonymous source projecting OpenAI’s revenue to potentially triple to US$12.7 billion this year and reach $29.4 billion in 2026, driven by its paid software plans. Additionally, reports surfaced of a record-breaking funding round worth US$40 billion led by Stargate co-contributor SoftBank Group (TSE:9984). The deal is reportedly near completion and would double OpenAI’s valuation, bringing it near US$300 billion.

These developments emphasize OpenAI’s position as a dominant force in the AI landscape

5. Microsoft reportedly cuts data center plans

Shares of Microsoft closed down on Wednesday after an analyst note from TD Cowen alleged that the tech conglomerate had abandoned plans for new data centers in the US and Europe, citing potential oversupply.

According to Bloomberg, Google and Meta have taken over some of the affected leases, although neither company has responded publicly to the note. In a statement from Microsoft obtained by the publication, the company said “significant investments” have left it “well positioned to meet our current and increasing customer demand.”

“While we may strategically pace or adjust our infrastructure in some areas, we will continue to grow strongly in all regions,” the spokesperson said. “This allows us to invest and allocate resources to growth areas for our future.”

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.