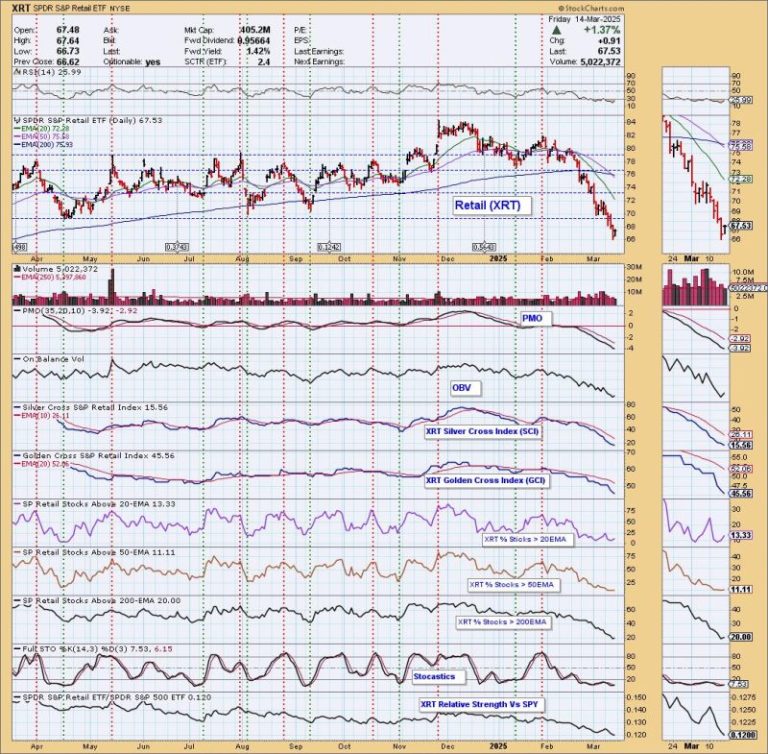

This week brought a rollercoaster ride for the stock market

A dramatic Monday (March 10) selloff hit mega-cap tech stocks hard, and was followed by a correction in the S&P 500 (INDEXSP:.INX) on Tuesday (March 11). Friday (March 14) witnessed a partial recovery fueled by a week of positive economic data; however, lingering uncertainties about global conflicts and potential tariffs kept overall gains in check.

The latest University of Michigan consumer sentiment survey, released on Friday, reveals a 10.5 percent decrease in consumer confidence in March, reflecting a broader 27.1 percent decrease for the year.

Tesla (NASDAQ:TSLA) led the retreat on Monday with a significant 12.25 percent drop by the closing bell. The decline came as CEO Elon Musk continued to cause controversy over his actions at the Department of Government Efficiency.

Protests this week included calls for a boycott of the company’s electric vehicles. After news hit that Tesla plans to make a lower-cost version of its Model Y in Shanghai, shares rose 3.9 percent to end the week at US$249.98.

Here’s a look at other key events that made tech headlines this week.

1. CoreWeave continues expansion with OpenAI deal

Insider told Reuters on Monday that AI startup CoreWeave has signed a five year contract worth US$11.9 billion with OpenAI to provide cloud computing services in exchange for a stake in CoreWeave worth approximately US$350 million.

CoreWeave will issue the shares through a private placement at the time of its initial public offering (IPO), which is expected to take place sometime in March. Investor interest in CoreWeave has grown since the company filed for an IPO on March 3. Investment research platform Sacra reveals a 730 percent increase in revenue between 2023 and 2024, and the company is projecting further revenue growth of over 320 percent to US$8 billion in 2025.

Multiple outlets have reported that the company is seeking to raise US$4 billion, targeting a valuation of US$35 billion. CoreWeave has also recently acquired the machine learning platform Weights & Biases.

However, the filing also revealed substantial debt and losses, and analysts have warned that CoreWeave’s multibillion-dollar partnership with its primary customer, Microsoft (NASDAQ:MSFT), and, to a lesser extent, its reliance on chips from NVIDIA (NASDAQ:NVDA), represent concentration risks. Analysts for Fitch Solutions believe that the agreement with OpenAI will alleviate some of those concerns.

2. Oracle stumbles after earnings report

Oracle (NYSE:ORCL) delivered its latest quarterly results on Monday, showing a mixed financial performance.

The company’s cloud infrastructure saw healthy growth thanks to demand for computing power, surging by 49 percent to US$2.7 billion. Meanwhile, its cloud services revenue reached US$11.01 billion, a 10 percent increase from the previous year; this segment accounted for 78 percent of Oracle’s total sales.

“We are on schedule to double our data center capacity this calendar year,” said Chair Larry Ellison.

Oracle’s total revenue and net income both saw substantial growth, reaching US$14.1 billion and US$2.9 billion, with annual increases of 6 percent and 22 percent, respectively.

However, the results did not quite meet investor forecasts, which anticipated US$14.39 billion in revenue. Earnings per share (EPS) also came up short at US$1.47 versus the expected US$1.49.

According to CNBC, Oracle CEO Safra Catz said during an earnings call that the US$48 billion in new contracts from this period has brought the company’s remaining performance obligations to over US$130 billion, a 62 percent increase from last year. Notably, this figure doesn’t include contracts related to the Stargate venture announced earlier this year with SoftBank Group (TSE:9984) and OpenAI.

Looking ahead, Oracle expects EPS to be between US$1.61 and US$1.65, a notable difference from the forecast US$1.79. Catz also said that Oracle expects to double its capital expenditure to US$16 billion this year.

Despite these shortfalls, Oracle’s board of directors announced a 25 percent increase in the company’s quarterly cash dividend to US$0.50 per share. The Information reported this week that the company is also the leading contender for helping run TikTok operations in the US.

3. Intel names new CEO

Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE:TSM) approached NVIDIA, Advanced Micro Devices (AMD) (NASDAQ:AMD) and Broadcom (NASDAQ:AVGO) to propose a joint venture to operate Intel’s (NASDAQ:INTC) factories, according to a report from Reuters on Wednesday (March 12).

Qualcomm (NASDAQ:QCOM) was also approached in a separate discussion.

According to insiders familiar with the matter, the proposal would involve TSMC running operations at Intel’s chip-making (foundry) division while holding a stake of less than 50 percent.

The news sent shares of Intel 7 percent higher on Wednesday from its previous closing price.

The company has faced scrutiny from shareholders over its lagging chip business, and its share price has lost over 43 percent of its value compared to a year ago. Intel gained another 10 percent after hours on Wednesday, when the company named Lip-Bu Tan, a former board member, as its new CEO. In a letter to shareholders, Tan signaled that he intends to improve Intel’s chip foundry and did not address the report regarding TSMC.

After a rough several months, Intel ended the week up 18.82 percent.

4. Google powers humanoid robot

Google (NASDAQ:GOOGL) expanded its artificial intelligence (AI) capabilities by announcing two new Gemini Robotics models on Wednesday, along with an update to its large language model, Gemma 3.

Google’s AI research subsidiary, DeepMind, integrated its AI model, Gemini 2.0, with humanoid robots developed by Texas-based robotics company Apptronik. The two enterprises formed a partnership agreement to accelerate advancement in AI-powered humanoid robots in December 2024.

Apptronik was founded in 2016 and has developed 15 robotic systems, including NASA’s Valkyrie, which was built to help astronauts explore the Moon or Mars. The company’s flagship robot, Apollo, was designed as a general-purpose robotic assistant for a range of sectors, including aerospace and logistics, as well as retail and hospitality.

The robot made its debut in 2023. In March 2024, it partnered with Mercedes-Benz Group (OTC Pink:MBGAF,ETR:MBG) on a pilot program to test the robot in Mercedes’ manufacturing facilities.

Earlier this year, Apptronik secured US$350 million in a Series A funding round co-led by B Capital and Capital Factory, with Google also participating in the round.

On Thursday (March 13), Google launched an experimental capability to its chatbot, Gemini, giving users the option to connect Gemini to their search history and other apps for more personalized responses. Powered by Google’s Gemini 2.0 Flash Thinking model, the new feature is simply called Gemini with personalization.

“Early testers have found Gemini with personalization helpful for brainstorming and getting personalized recommendations,” said Dave Citron, senior director of product management for Gemini.

5. Cohere launches efficient, low-cost LLM

Canadian AI company Cohere revealed its newest large language model (LLM), Command A, a tool designed to help businesses handle complex tasks like coding by efficiently processing large data sets

“Command A is on par or better than GPT-4o and DeepSeek-V3 across agentic enterprise tasks — tasks where the LLM can act somewhat independently to complete a business goal — with significantly greater efficiency,’ the firm said.

What’s more, Cohere said it spent less than US$30 million to build the model, which can run on just two graphics processing units (GPUs). This is a stark contrast to the tens of thousands of GPUs used by other LLMs, demonstrating Cohere’s ability to achieve high performance with significantly optimized resource utilization.

In an interview with the Globe and Mail, Cohere co-founder Nick Frosst said the company achieved such amazing efficiency by focusing on fulfilling the needs of its customer base rather than pursuing the development of artificial general intelligence (AGI), AI systems that surpass human intelligence.

“We’re training it to be good at the things that our customers want,” he explained. “By being focused on that, we’ve been able to be significantly more efficient than the other players.

“The people who are saying AI is getting bigger and bigger are the people constantly saying they’re around the corner from AGI. That’s not our focus, nor is that my scientific belief.”

Cohere has attracted investment from a range of well-known venture capital firms, including Radical Ventures, SalesForce Ventures and Cisco Investments. It is also backed by prominent players in the AI sector, including Oracle, NVIDIA, AMD and SAP (NYSE:SAP), indicating strong confidence in its potential.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.